LIFE CYCLE COSTING

Life Cycle Costing (LCC) is a tool to assist in assessing the cost performance of any opportunity, aimed at facilitating choices where there are alternative means of achieving the client’s objectives and where those alternatives differ, not only in their initial costs but also in their subsequent operational costs. It allows these alternatives to be compared on the same basis.

It is used for budgeting and for option appraisal, for example:

LCC accounts for all relevant costs (only) over a defined period of time (the period of analysis).

It is used for budgeting and for option appraisal, for example:

- Higher expenditure on building fabric or insulation might lead to lower energy expenditure; or

- A lighter weight, more expensive cladding system might lead to savings on frame and foundation costs, but will also cost more when it is renewed; or

- A cheaper component might be less durable, and require more frequent replacement or maintenance.

LCC accounts for all relevant costs (only) over a defined period of time (the period of analysis).

WLC has a broader scope than LCC as it can include costs (and incomes) associated with the provision of the construction works that are not included in the client’s costs.

What are the benefits for the clients?

Option appraisal using life cycle costing is specifically required for public sector organisation and guidance publications, notably HM Treasury – The Green Book: Appraisal and Evaluation in Central Government. Equally, many private sector organisations now require life cycle costs to be taken into account.

It is relevant to projects at all 7 stages of the Digital Plan of Work, from brief through to in-use, but is particularly relevant to stages 1, 2, 3, 5 and 7 (for new, maintenance, renewal or improvement projects).

We can help you work through LCC analyses using our extensive database of norms drawn from hundreds of projects in the Health, Education, Accommodation, Defence, Housing and Civil Infrastructure sectors.

What are the benefits for the clients?

- LCC encourages analysis of business needs and then communicating this to the project team;

- Costs of ownership (through construction, purchase or renting) of alternative options are evaluated over their whole life;

- Total cost of ownership/occupation is optimised by balancing initial capital and running costs;

- Analysis of risks and costs of loss of functional performance due to failure or maintenance are included;

- LCC promotes realistic budgeting for operation, maintenance and repair;

- LCC encourages discussion and recording of decisions about the durability of materials and components at the outset of the project;

- LCC makes it more probable that the best value for money solution is adopted;

- LCC provides data on actual performance and operation compared with predicted performance for use in future predictions and benchmarking.

Option appraisal using life cycle costing is specifically required for public sector organisation and guidance publications, notably HM Treasury – The Green Book: Appraisal and Evaluation in Central Government. Equally, many private sector organisations now require life cycle costs to be taken into account.

It is relevant to projects at all 7 stages of the Digital Plan of Work, from brief through to in-use, but is particularly relevant to stages 1, 2, 3, 5 and 7 (for new, maintenance, renewal or improvement projects).

We can help you work through LCC analyses using our extensive database of norms drawn from hundreds of projects in the Health, Education, Accommodation, Defence, Housing and Civil Infrastructure sectors.

WHOLE LIFE VALUE

“A clear understanding of the current and future running costs of built assets is essential knowledge if one intends to unlock whole life value”.

So, what is Whole Life Value? Identifying and understanding Whole Life Value is the key to making long-lasting, sustainable investments and decisions for your business.

Whole Life Value is about identifying what “value” really means to your business, whether it’s monetary returns on investment, meeting demand, reducing your carbon footprint, or something else entirely. Once you’ve pinpointed what value means to your business, Whole Life Value works by helping you sustain that value at every point of your asset’s life cycle, from design and concept to decommission and replacement.

Our personnel are among the best trained and most experienced in this highly specialised sector. Our goal is to deliver future certainty in an uncertain world. Your satisfaction is of paramount importance.

So, what is Whole Life Value? Identifying and understanding Whole Life Value is the key to making long-lasting, sustainable investments and decisions for your business.

Whole Life Value is about identifying what “value” really means to your business, whether it’s monetary returns on investment, meeting demand, reducing your carbon footprint, or something else entirely. Once you’ve pinpointed what value means to your business, Whole Life Value works by helping you sustain that value at every point of your asset’s life cycle, from design and concept to decommission and replacement.

Our personnel are among the best trained and most experienced in this highly specialised sector. Our goal is to deliver future certainty in an uncertain world. Your satisfaction is of paramount importance.

OBJECTIVE OPTIONS SELECTION

In simple terms we provide the tools and techniques to make objective investment decisions by routinely removing ‘optimism bias’; where one has cause to believe that they themselves are less likely to experience a negative outcome. Our approach also looks to remove ‘confirmation bias’; where is the tendency to search for, interpret, favour, and recall information in a way that confirms or supports one's prior beliefs or values e.g. “this project will be a success because the last one was” even though the variables such as land price, construction costs and market are fundamentally different.

Our tools and techniques involve robust processes and cost models which allow for a range of input variables and dynamic modelling of scenarios; in simple terms we explore the boundary of the credible to support you in making tough decisions.

Our tools and techniques involve robust processes and cost models which allow for a range of input variables and dynamic modelling of scenarios; in simple terms we explore the boundary of the credible to support you in making tough decisions.

INVESTMENT AND DEVELOPMENT APPRAISAL

Investment and Development Appraisal considers the merits of a series of options using an objective ‘level playing field’ approach. There is almost always more than one way to achieve an outcome; when considering ways to increase manufacturing output one could consider:

In this scenario there are a range of revenue and capital inflows and outflows which need to be considered in order to determine the best value for money. We provide the tools and techniques, and you provide the inputs; once we’ve tailored a model that is specific to your opportunity, we will work with you to develop a 'base case' against which sensitivity analyses and scenario models allow you to determine, objectively, the relative merits of one option over another.

- Investment in a significant capital asset (automation); or

- Increasing workforce (including building or renting more space); or

- Outsourcing.

In this scenario there are a range of revenue and capital inflows and outflows which need to be considered in order to determine the best value for money. We provide the tools and techniques, and you provide the inputs; once we’ve tailored a model that is specific to your opportunity, we will work with you to develop a 'base case' against which sensitivity analyses and scenario models allow you to determine, objectively, the relative merits of one option over another.

BUSINESS CASE WRITING AND SUPPORT

We often find that it’s not enough to point at the number in the bottom right-hand side of a spreadsheet and use that alone as justification for major investments and all that entails; including management of risk, achievement of returns, delivery to schedule etc. All of the material matters impacting on investments need to be considered and explored including the rationale for doing anything at all especially when doing ‘nothing’ might also be a credible option!

A compelling business case adequately captures both the quantifiable and non-quantifiable characteristics of a proposed project. We can help you formulate your own business case or write it with you; pulling together the constituent parts necessary for submission to the decision makers including helping you through the governance steps specific to your sector.

We aim to ensure that that your business cases are:

We will work with you to ensure that critical success factors are documented and that as time passes your business cases will have a longer ‘shelf life’ i.e. the case remains sound even allowing for the inevitability of project change and variance to cost and/or schedule.

A compelling business case adequately captures both the quantifiable and non-quantifiable characteristics of a proposed project. We can help you formulate your own business case or write it with you; pulling together the constituent parts necessary for submission to the decision makers including helping you through the governance steps specific to your sector.

We aim to ensure that that your business cases are:

- Verifiable - project requirements are understood; what is the need versus want?

- Tailored - to the size, complexity and risk of the proposal

- Consistent - we ensure that the same business issues are addressed by each proposal

- Focused - our independence means that we are only concerned with the business capabilities and impact; we will not be distracted by technical details

- Comprehensive - ensures that all factors relevant to a complete evaluation are considered

- Written in plain language - the contents are clearly relevant, logical and, although demanding, are simple to complete and evaluate

- Measurable - all key aspects can be quantified so their achievement can be tracked and measured

- Transparent - key elements can be justified directly

- Accountable - accountability and commitments for the delivery of benefits and management of costs are clear.

We will work with you to ensure that critical success factors are documented and that as time passes your business cases will have a longer ‘shelf life’ i.e. the case remains sound even allowing for the inevitability of project change and variance to cost and/or schedule.

PROGRAMME MANAGEMENT CONSULTANCY

Complex programmes require the application of robust but simple approaches and common sense. How do you keep on top of things when ‘everything’ has changed compared to ‘day one’? Our team is experienced in working in the Programme Management Office (PMO) environment and we would love to help you navigate this area whether this is at Enterprise level or at a more local level:

We have the skills and experience to help you determine some of the more challenging questions facing a PMO like “what do we tackle first?” or “what happens if we stop this project?”.

- Enterprise PMO: ensures that projects align with the organisation strategy and objective; these have the broadest remit of all PMO types, typically reporting direct to the CEO (or similar role) and have authority to make strategic and tactical decisions across all projects.

- Divisional PMO: provides support to projects for a specific business unit within an organisation; includes portfolio management, training, resource planning, and project coordination.

- Project PMO: established for the duration of a single large project or program; includes administrative support, controlling, reporting, and monitoring.

- Project Management Centre of Excellence (PMCoE): defines standardised project management standards, procedures, methods, and tools to support project teams across an entire organisation; includes administrative services and training in process, methodology, and tools.

We have the skills and experience to help you determine some of the more challenging questions facing a PMO like “what do we tackle first?” or “what happens if we stop this project?”.

PROJECT CONTROLS CONSULTANCY

Planning, planning, planning (other project controls disciplines do exist!). Whether you are tinkering with Microsoft Project© or knee deep in Primavera P6© we can help you get the best out of the people and tools that you’ve invested in, using our real-world knowledge. Whether you need coaching in the use of the tools or an independent facilitator to host and run an interactive planning session we can help.

Our project controls consultancy can help support you with the following:

One of the often-heard phrases is “the estimate was wrong”; we aim to help you leave that term in the past as our project controls processes help you to prepare the ground prior to commencement of the estimating process. By linking Project Requirements into the planning phase, we will show you how to account for the time (planning), cost (estimating) and degree of uncertainty applicable to your investment opportunity. Each project has its own individual characteristics even if ostensibly it is similar to something you’ve done before. Bringing risk identification and management into the mix enables us to differentiate the risks and opportunities specific to your new scheme; our aim would be to help you see a little further over the horizon before it’s too late and in good time for a bit of ‘course correction’.

Our project controls consultancy can help support you with the following:

- Planning and Scheduling

- Risk Management (includes identification & assessment)

- Cost estimating and management

- Scope and Change Management

- Earned Value Management

- Document Control

- Supplier Performance

- Maintaining the project baseline

- Reporting

- BIM and Information Management

One of the often-heard phrases is “the estimate was wrong”; we aim to help you leave that term in the past as our project controls processes help you to prepare the ground prior to commencement of the estimating process. By linking Project Requirements into the planning phase, we will show you how to account for the time (planning), cost (estimating) and degree of uncertainty applicable to your investment opportunity. Each project has its own individual characteristics even if ostensibly it is similar to something you’ve done before. Bringing risk identification and management into the mix enables us to differentiate the risks and opportunities specific to your new scheme; our aim would be to help you see a little further over the horizon before it’s too late and in good time for a bit of ‘course correction’.

TECHNICAL DUE DILIGENCE

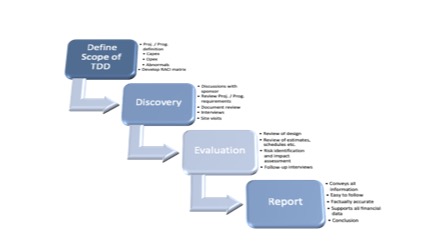

Effective governance supports the verification and validation of project information at any stage in the project lifecycle; before, during, and even after completion. We are experienced in the drafting of technical due diligence (TDD) reports primarily prior to project commencement in support of investment decisions and to support credit committees in their evaluation of the viability of the proposal. However, it is not unusual for us to undertake due diligence after project initiation by tracking progress to plan and budget or after completion in support of refinancing or distribution of profits to shareholders or other parties with equity in the schemes.

The approach we would take when undertaking due diligence on a new project is outlined below but would need to be tailored for each specific case:

The approach we would take when undertaking due diligence on a new project is outlined below but would need to be tailored for each specific case:

The key here is to undertake a dispassionate assessment of the project or programme, shining light on areas which perhaps haven’t received sufficient consideration or identifying risks which, should they occur, may have a disproportionate impact.

Our approach is to compare and contrast the subject of the TDD with comparable schemes in order to determine the relative maturity of design, estimate, schedule and risk register and the extent to which the proposals meet or fall short of requirements.

Our approach is to compare and contrast the subject of the TDD with comparable schemes in order to determine the relative maturity of design, estimate, schedule and risk register and the extent to which the proposals meet or fall short of requirements.

FACILITIES MANAGEMENT CONSULTANCY

From insourcing to outsourcing, M&E tendering to wellbeing strategies, auditing to benchmarking, TLC's facilities management consultancy advises across the full range of facilities management services. We offer solutions in both soft and hard services and provide tailored consultancy packages to meet specific needs.

Working across all sectors we bring best FM practice across the traditional sector boundaries and, being practitioners in both hard and soft services, we offer a cohesive approach.

Working across all sectors we bring best FM practice across the traditional sector boundaries and, being practitioners in both hard and soft services, we offer a cohesive approach.

We have established a reputation for industry best practice and building long term relationships with our clients, who value the expertise and difference we can bring to their business, across a wide range of sectors and within both the traditional and PFI/PPP markets.

LIFECYCLE REVIEWS

Many large projects require private finance with senior debt being repaid over 25 years and in some cases bond finance allows concessions of up to 40 years. During the repayment of the design and build loans there is a requirement to maintain facilities in good repair in order to meet the end-users’ needs and to retain value. The Lifecycle plan at the project’s inception will estimate the timings and costs of asset renewals over the length of the concession in order to maintain performance and condition. It is conventional to fund a Maintenance Reserve Account (MRA) from revenue to pay for the Lifecycle asset renewals.

We can undertake reviews on your behalf in order to determine whether or not your Lifecycle remains on plan, ahead or behind target. This review can help determine if more or less revenue should be set aside to fund the MRA and whether or not it would be prudent, when contract provisions allow, to take a surplus as a dividend to equity owners/beneficiaries in the event that the fund is over provisioned.

We can undertake reviews on your behalf in order to determine whether or not your Lifecycle remains on plan, ahead or behind target. This review can help determine if more or less revenue should be set aside to fund the MRA and whether or not it would be prudent, when contract provisions allow, to take a surplus as a dividend to equity owners/beneficiaries in the event that the fund is over provisioned.

RISK AND OPPORTUNITY MANAGEMENT

Risk management is the identification, evaluation, and prioritisation of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimise, monitor, and control the probability or impact of unfortunate events or to maximise the realisation of opportunities.

We can help you with project and programme risk management; it must be considered at the different phases of acquisition. In the beginning of a project, the advancement of technical developments, or threats presented by a competitor's projects or changing economic landscape, may cause a risk or threat assessment and subsequent evaluation of alternatives. Once a decision is made, and the project begun, more familiar project management applications can be used:

We can help you with project and programme risk management; it must be considered at the different phases of acquisition. In the beginning of a project, the advancement of technical developments, or threats presented by a competitor's projects or changing economic landscape, may cause a risk or threat assessment and subsequent evaluation of alternatives. Once a decision is made, and the project begun, more familiar project management applications can be used:

- Planning how risk will be managed in the particular project. Plans should include risk management tasks, responsibilities, activities and budget for mitigations.

- Assigning a risk manager – a team member other than a project manager who is responsible for foreseeing potential project problems. Typical characteristic of risk manager is a healthy scepticism.

- Developing and maintaining live project risk register. Each risk should have the following attributes: opening date, title, short description, probability and impact score. Optionally a risk may have an assigned person responsible for its resolution and a date by which the risk must be resolved or minimised.

- Creating anonymous risk reporting channel. Each team member should have the opportunity to report risks that they foresee in the project without bias.

- Preparing mitigation plans for risks that are chosen to be mitigated. The purpose of the mitigation plan is to describe how this particular risk will be handled – what, when, by whom and how will it be done to avoid it or minimise consequences if it occurs.

- Summarising planned and potential risks, effectiveness of mitigation activities, and effort spent on risk management.

Megaprojects (sometimes also called "major programmes") are large-scale investment projects, typically costing more than USD $1 billion per project. Megaprojects include major bridges, tunnels, highways, railways, airports, seaports, power plants, dams, wastewater projects, coastal flood protection schemes, oil and natural gas extraction projects, public buildings, information technology systems, aerospace projects, and defence systems. Megaprojects have been shown to be particularly risky in terms of finance, safety, and social and environmental impacts. Risk management is therefore particularly pertinent for megaprojects and we have the experience and tools to help manage challenges on this scale. In our terms we apply simple methods, consistently without jargon.

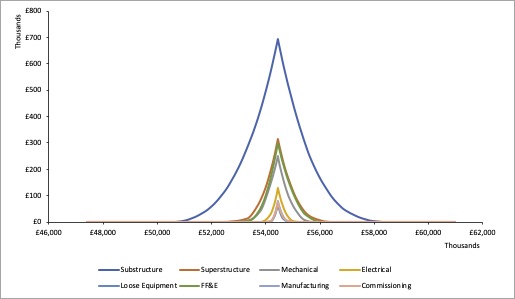

RISK AND OPPORTUNITY MODELLING

Probability is something we deal with during our lives; whether or not we choose to take an umbrella with us based on the likelihood of rain or perhaps we elect to follow a healthier lifestyle in order to improve one's chances of a longer life. However, probability theory is also useful when it is applied to commercial problems encountered every day in the built environment. Through Life Costing can supply the expertise and approach needed to fully understand the range of possible outcomes from investment decisions whether these are short term in the form of construction/engineering projects or long-term facilities contracts.

Our approach to this subject and the models we build are simple to understand and accompanied by reports which summarise the findings and help you determine the best courses of action.

- We apply analytical methods for modelling risk, for example, failure mode and effects analysis, probability models, fault trees, event trees

- We apply techniques to quantify and calibrate expert judgement

- We understand the role of uncertainty analysis and human factors in risk modelling

- We appreciate the difficulties of translating risk measurement methods into tools for regulation and management

Our approach to this subject and the models we build are simple to understand and accompanied by reports which summarise the findings and help you determine the best courses of action.

“Value isn't measured only by what you’ve spent” Richard Allard, Through Life Costing